- Market Overview

- Futures

- Options

- Charts

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Hedging Resource Center

- Farmer's Almanac

- USDA Reports

Winter is Coming - Natural Gas Demand Poised to Go Higher

I am Stephen Davis, senior market strategist at Walsh Trading, Inc., in Chicago, Illinois. Contact me at 312-878-2391.

Ahead of the winter heating season, U.S. natural gas futures climbed to $3/MMBtu, the highest in one week, as output slipped. Production in the Lower 48 averaged 107.4 bcfd in September, down from August’s record 108.3, amid pipeline work and declines in Texas, West Virginia and Pennsylvania. In addition, Berkshire Hathaway's Cove Point natural gas export facility is expected to shut down for annual maintenance for about three weeks beginning this month.

In its Short-Term Energy Outlook published last week, U.S. Energy Information Administration (EIA) said, “We expect the Henry Hub natural gas spot price will rise from an average of $2.91 per million British thermal units (MMBtu) in August to $3.70/MMBtu in 4Q25 and $4.30/MMBtu next year. Rising natural gas prices reflect relatively flat natural gas production amid an increase in U.S. liquefied natural gas exports.”

In its Natural Gas Weekly Update for the week ending September 10, the EIA reported the Henry Hub spot price fell 11 cents from $3.00 per million British thermal units (MMBtu) on September 3 to $2.89/MMBtu on September 9. The report also noted that the price of the October 2025 NYMEX contract decreased 4 cents, from $3.064/MMBtu to $3.029/MMBtu in the same time period. Also, it states that the price of the 12-month strip averaging October 2025 through September 2026 futures contracts declined 3 cents to $3.696/MMBtu.

An option trade strategy would be sell three October natural gas $3.00 puts at 59 ($590). With that premium in your account, buy one November natural gas 350 call at 0.180 ($1,800). The puts you sell will pay for the call that you will buy. The October natural gas puts expire on September 25, 2025. I like selling these options. Looking at the charts below, in my opinion natural gas will not reach $3.00 this month.

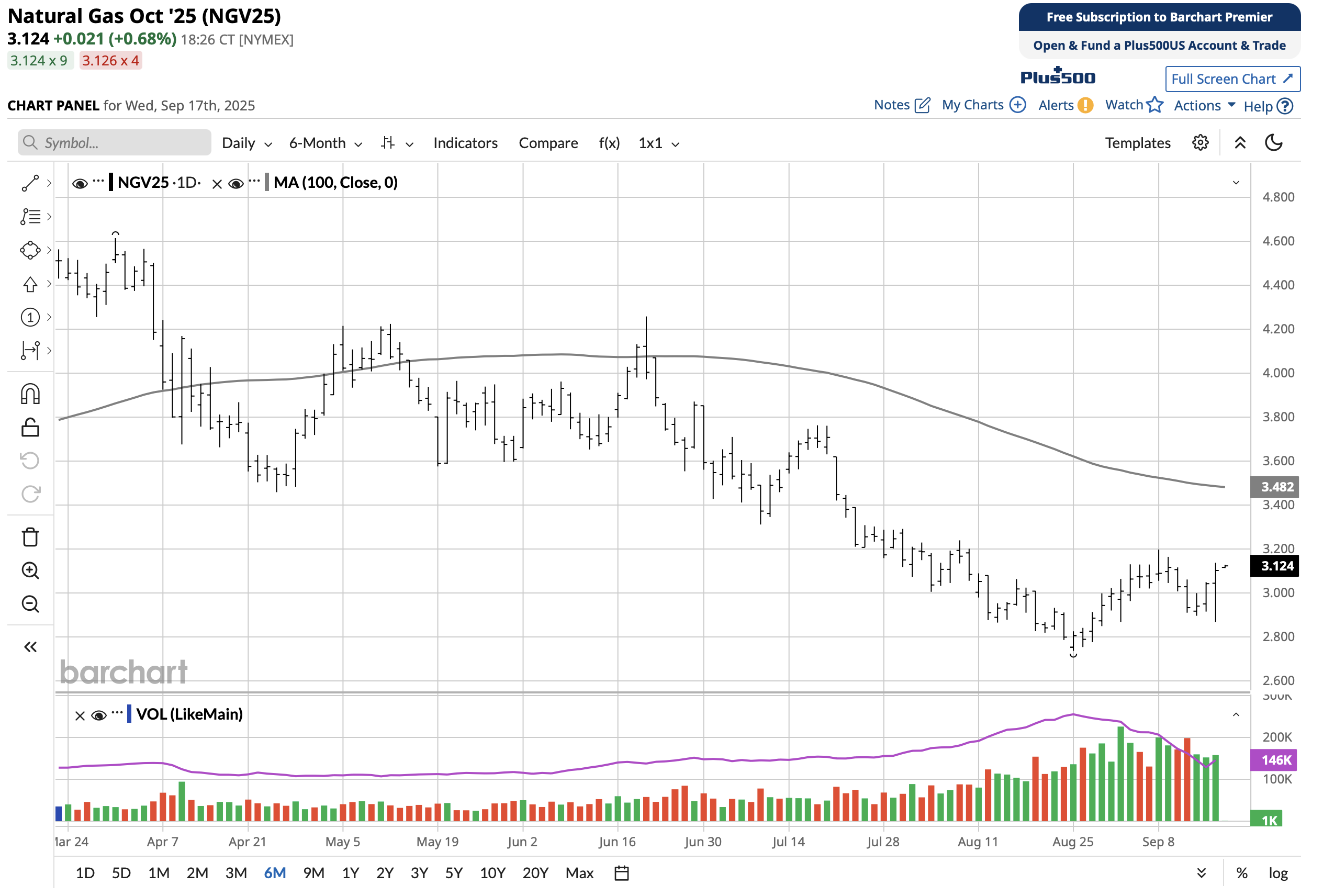

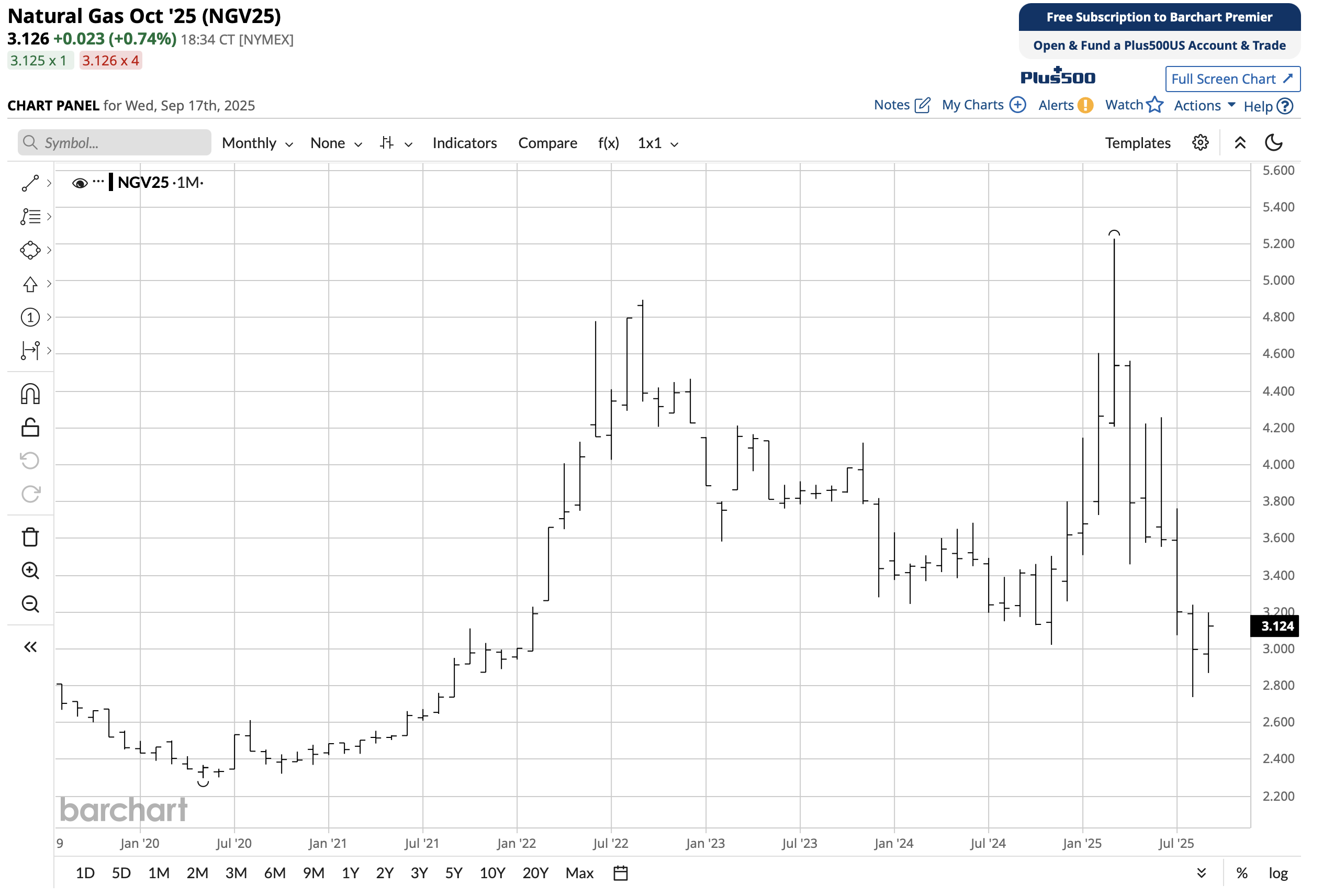

The first chart is a daily October natural gas showing a reversal up that could continue for the next 72 hours, in my opinion. Look at the 100-period moving average line on the chart – that's where the market is heading, in my opinion. The second chart is the monthly natural gas chart. It shows we are in the low of the range for natural gas prices for the last four years. It also shows three months of lower highs and lower lows. Sometimes the markets go in threes, in my opinion, and this might be it for natural gas trading lower. Winter is coming and natural gas will be in demand.

Stephen Davis

Senior Market Strategist

Walsh Trading

Direct 312 878 2391

Toll Free 800 556 9411

sdavis@walshtrading.com

www.walshtrading.com

Use this link to join my email list: SIGN UP NOW

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.